The Key to Fortune: Start Early

Students looking to earn money for their future should start buying shares of stocks sooner than later

November 5, 2021

With business closures due to Covid-19, families face the stressful uncertainty of funding their future to dwell upon while unemployed, or in work hiatus. With the ever-changing economy to account for, the younger generations have to face a potentially dismal future. What more students should engage in is stock investment and trading, more specifically the most popular form of stocks: long term investing.

Students with the opportunity to initially fund stock investment—who will need money for college and their life after education—would be in a more secure financial place and ought to get to it. The sooner students invest, the more time their money has to work for them, growing equity. To invest in stocks long term (a year or longer) it’s best to gather some savings and buy a few company shares then let it sit and gain value as the company and stock share values grow over time, making the investor’s money grow exponentially. An overhanging stress of funds for college and after school expenses sits in all students and parents minds, and being able to aid that by making money, without the labor, as to put towards college funding is efficient and gives time for other forms of income or school work.

Max Mees, a Summit alumni, says “I buy shares of bigger companies for long term investment, like Disney and Tesla. Long term investment avoids the taxes on short term gains that come with day trading.” This is another benefit of investing long term for students: being young. The value of their stocks has more time to appreciate as students age. This also avoids the taxes Mees mentions; every time a stock share is purchased or sold with capital gain there is a tax put on the investor for the exchange.

“Over quarantine I did some day trading with small companies but didn’t like how I was taxed at a higher rate because it was short term.” A sophomore attending Chandler High School near Phoenix, Ariz. shares, “So I took the funds made from that as savings and put it into Moderna shares, and I’m planning to leave it there until I need the money for college.”

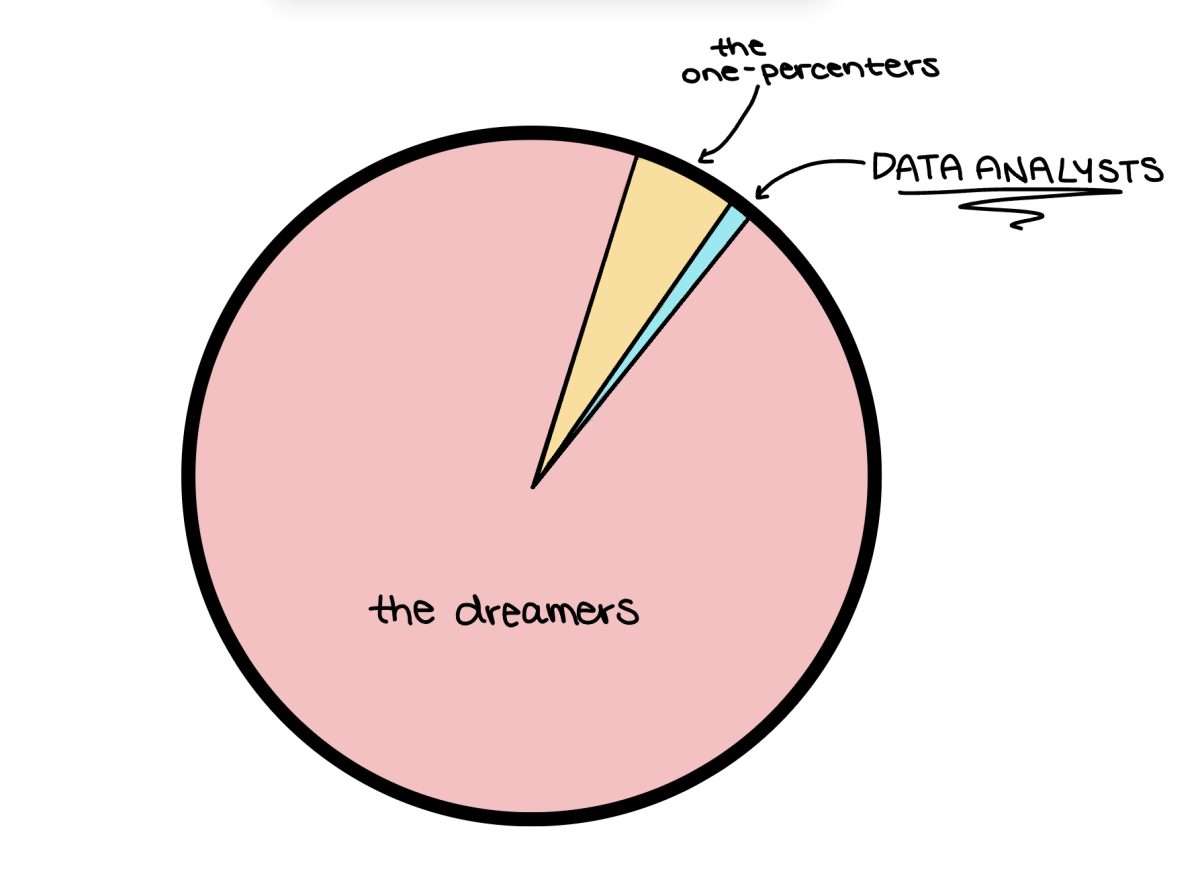

A major challenge that coincides with students investing is that one must have disposable personal income that they can allocate for initial shares to hold on to. Keeping in mind this investing strategy is for students who are fortunate enough to have monies available. Students who have the opportunity to put a paycheck towards shares would reap the benefits.

Long term investments are best for minimal work and growing money exponentially. The earlier students buy and hold onto stocks, giving the value more time to prosper, the better it is for their future. It’s always a good idea to have capital available for savings being put towards college, housing or simply for extra security and confidence for the hereafter.